Financial Risk Meter

Risk Profile Calculator (Please either enter the numeric value in the boxes or use the sliders to select the right amount)

1. What is your Investment horizon? How long can you keep your money invested in the market before needing access to it?

3. Would you agree that as your wealth is a part of your family nest and your individual age will not be relevant:

How would you react if the value of your single investment fell by more than 30% in any year?

10. Investments carrying a higher risk come with a bigger chance of achieving higher returns, but also a bigger chance of incurring substantial losses. Each investor has a different appetite for risk. Suppose you had Rs. 1 crore to invest, which of the following return scenarios would be most attractive to you?

What proportion of your assets would you wish to invest with us in instruments other than risk free deposits?

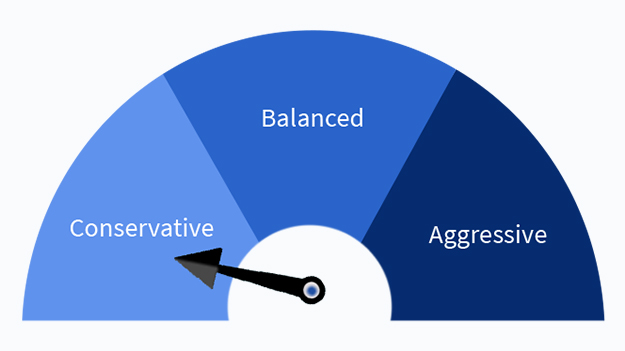

Our Risk Profile has identified

you as Conservative

you as Conservative